Amur Capital Management Corporation Fundamentals Explained

Amur Capital Management Corporation Fundamentals Explained

Blog Article

Facts About Amur Capital Management Corporation Revealed

Table of ContentsAmur Capital Management Corporation Fundamentals ExplainedRumored Buzz on Amur Capital Management CorporationAmur Capital Management Corporation - An OverviewThe Best Strategy To Use For Amur Capital Management CorporationSome Known Factual Statements About Amur Capital Management Corporation The Best Guide To Amur Capital Management Corporation

International direct financial investment (FDI) happens when an individual or business possesses at the very least 10% of an international firm. When financiers own less than 10%, the International Monetary Fund (IMF) specifies it just as component of a supply portfolio. Whereas a 10% possession in a company doesn't offer a private capitalist a regulating rate of interest in a foreign company, it does permit influence over the company's administration, operations, and overall plans.Firms in creating countries need international funding and know-how to expand, provide structure, and lead their worldwide sales. These foreign firms need personal investments in infrastructure, power, and water in order to increase tasks and salaries (mortgage investment corporation). There are numerous levels of FDI which range based upon the sort of business involved and the reasons for the financial investments

Top Guidelines Of Amur Capital Management Corporation

Various other forms of FDI consist of the acquisition of shares in a connected business, the consolidation of a wholly-owned company, and participation in an equity joint venture across worldwide limits (https://preorr-twuac-physeimp.yolasite.com/). Investors that are intending to take part in any kind of sort of FDI could be wise to weigh the financial investment's benefits and negative aspects

FDI increases the manufacturing and solutions market which causes the production of jobs and helps to decrease joblessness rates in the country. Increased employment translates to higher earnings and furnishes the populace with more purchasing powers, improving the general economic climate of a nation. Human funding included the understanding and capability of a labor force.

The production of 100% export oriented systems help to assist FDI investors in boosting exports from various other nations. The circulation of FDI right into a nation equates right into a continuous circulation of fx, assisting a country's Central Bank maintain a flourishing get of fx which causes steady exchange rates.

The Best Strategy To Use For Amur Capital Management Corporation

Foreign direct financial investments can in some cases influence exchange rates to the benefit of one country and the hinderance of another. When investors spend in foreign areas, they might see that it is a lot more pricey than when goods are exported.

Taking into consideration that foreign straight investments may be capital-intensive from the viewpoint of the financier, it can occasionally be really dangerous or financially non-viable. Consistent political modifications can bring about expropriation. In this case, those nations' governments will certainly have control over investors' building and assets. Lots of third-world countries, or at the very least those with background of colonialism, stress that international direct financial investment would result in some kind of modern financial manifest destiny, which exposes host countries and leave them prone to international firms' exploitation.

Protecting against the success void, boosting wellness end results, enhancing revenues and supplying a high price of economic returnthis one-page file summarizes the advantages of spending in top quality very early youth education and learning for deprived kids. This paper is often shown to policymakers, supporters and the media to make the situation for early youth education.

Getting My Amur Capital Management Corporation To Work

Think about how gold will certainly fit your economic goals and long-lasting investment plan prior to you spend - capital management. Getty Images Gold is commonly considered a strong possession for and as a in times of unpredictability. The precious metal can be appealing with durations of economic unpredictability and economic crisis, as well as when inflation runs high

The Single Strategy To Use For Amur Capital Management Corporation

"The ideal time to build and allocate a version portfolio would be in much less unpredictable and stressful times when feelings aren't regulating decision-making," states Gary Watts, vice head of state and monetary consultant at Wealth Enhancement Group. After all, "Seafarers attire and arrangement their boats before the storm."One means to identify if gold is ideal for you is by investigating its advantages and disadvantages as an investment selection.

So, if you have cash, you're successfully losing cash. Gold, on the other hand, may. Not every person agrees and gold may not always increase when rising cost of living goes up, yet it might still be an investment factor.: Getting gold can potentially help investors get with uncertain economic problems, taking into consideration the during these durations.

What Does Amur Capital Management Corporation Do?

That doesn't indicate gold will certainly constantly increase when the economic situation looks unsteady, yet it can be great for those that intend ahead.: Some capitalists as a means to. As opposed to having all of your money tied up in one asset link course, various can possibly aid you better handle danger and return.

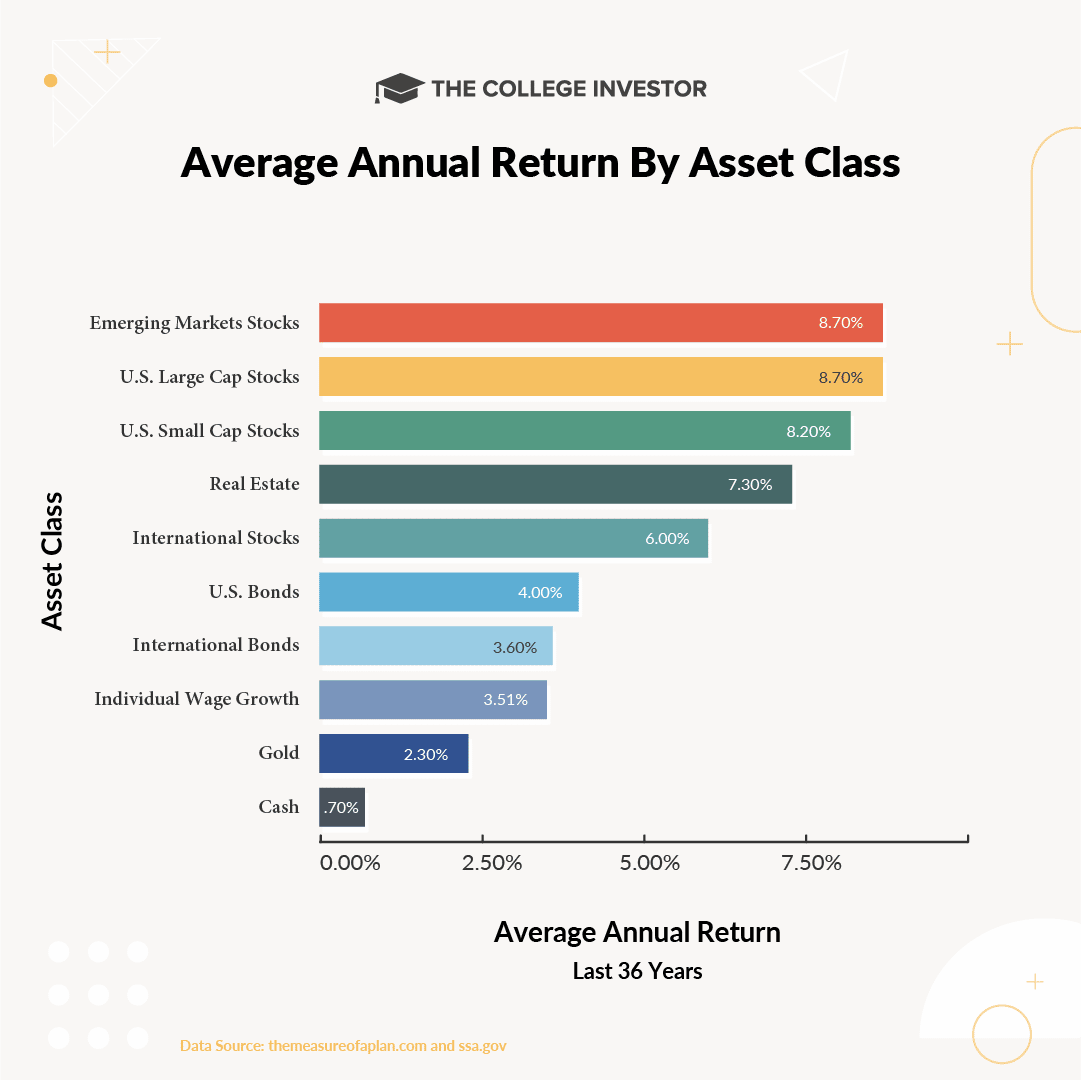

If these are several of the advantages you're searching for then begin investing in gold today. While gold can help include balance and protection for some capitalists, like a lot of investments, there are additionally risks to keep an eye out for. Gold could exceed other possessions throughout particular periods, while not holding up also to long-lasting rate recognition.

Report this page